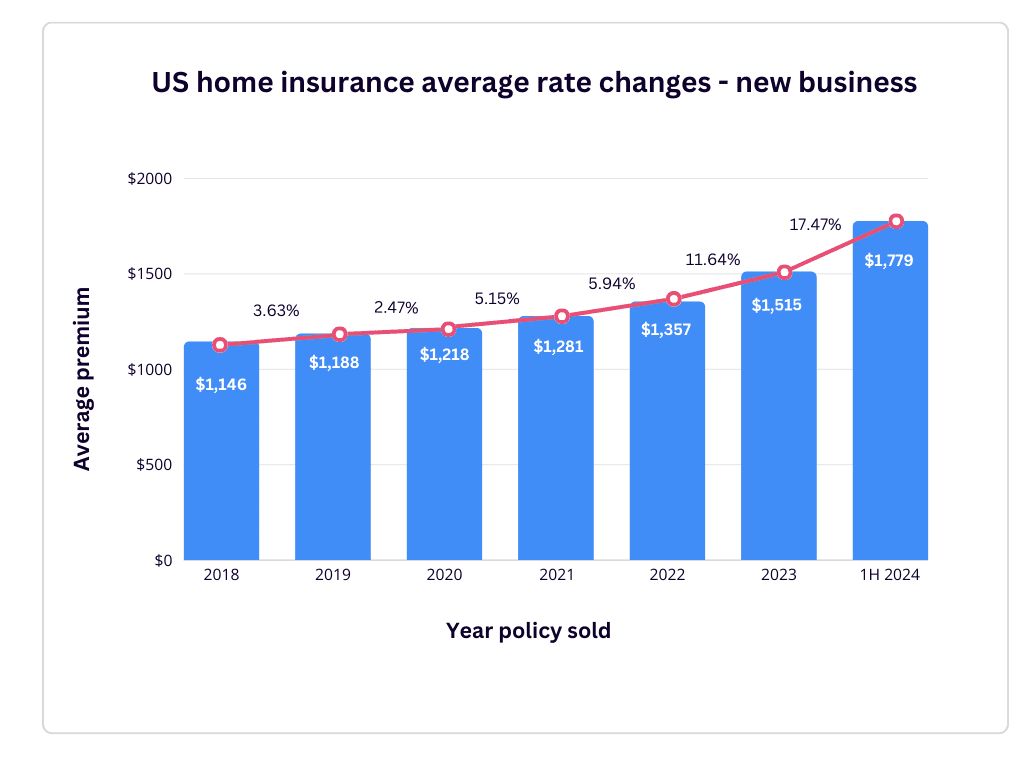

North Carolina Home Insurance Premiums to Increase by 15% Statewide by 2026

RALEIGH, NC — North Carolina homeowners will see their insurance premiums rise over the next two years following a settlement between the N.C. Department of Insurance and the N.C. Rate Bureau. The settlement, announced by Insurance Commissioner Mike Causey, brings an end to a legal dispute over proposed rate hikes filed by insurance companies in January 2024.

Under the agreement, statewide base rates for homeowners’ insurance will increase by an average of 7.5% starting June 1, 2025, and an additional 7.5% on June 1, 2026. This results in an overall average increase of approximately 15% by mid-2026.

Settlement Details

The settlement significantly reduces the insurance industry’s initial proposal, which sought a statewide average increase of 42.2% and increases as high as 99.4% in some coastal areas. Commissioner Causey rejected the proposal in 2024, leading to months of legal proceedings and negotiations.

“This settlement is a big win for North Carolina homeowners,” said Causey. “We fought to protect consumers from excessive rate hikes while ensuring insurance companies have adequate funds to pay claims for natural disasters.”

Under the agreement:

- Coastal Areas: Beach communities in Brunswick, Carteret, New Hanover, Onslow, and Pender counties will see the steepest increases—16% in mid-2025 and 15.9% in mid-2026.

- Eastern Coastal Areas: These regions will experience increases of 10.5% in 2025 and 10.1% in 2026.

- Mountain Areas: Counties like Buncombe, Watauga, and Yancey will see smaller increases, averaging 4.4% in 2025 and 4.5% in 2026.

- Urban Areas: Raleigh and Durham will face 7.5% annual increases, while Charlotte homeowners will experience 9.3% in 2025 and 9.2% in 2026.

The settlement also prohibits the N.C. Rate Bureau from proposing additional rate increases before June 1, 2027.

Why Are Rates Increasing?

The N.C. Rate Bureau, which represents insurance companies in the state, attributed the need for higher rates to several factors:

- Increased claims due to stronger and more frequent storms, including Hurricanes Matthew (2016) and Florence (2018).

- Rising inflation, particularly in construction materials.

- Escalating reinsurance costs driven by national and global catastrophes.

“Storms have gotten stronger and more damaging, more people are living in disaster-prone areas, and reinsurance costs have exploded,” said Rate Bureau Chief Operating Officer Jarred Chappell. “While this settlement is a step in the right direction, it’s clear that these cost drivers remain a challenge.”

Consumer Reactions

Homeowners across the state have expressed concern about the financial impact of rising premiums. While many appreciate that the settlement curbs what could have been significantly higher increases, the gradual hikes will still strain household budgets, especially in areas already dealing with disaster recovery.

“This is going to be tough for families living paycheck to paycheck,” said Mary Allen, a homeowner in Carteret County. “We’re already paying more for groceries and utilities. Now we have to prepare for higher insurance bills.”

Additional Protections and Future Outlook

The settlement ensures that North Carolina homeowners will save an estimated $777 million in premiums over the next two years compared to the original proposal. It also maintains a “consent-to-rate” exception in state law, which allows high-risk homeowners to secure insurance at premiums up to 250% of the bureau’s rate. This measure has helped prevent a mass exodus of insurers from disaster-prone areas.

As Commissioner Causey begins his third term, he emphasized the importance of balancing consumer protection with the financial stability of insurance providers. “These increases are necessary to ensure insurers can cover claims and remain in the market. However, we will continue to advocate for fair rates and transparency in the insurance industry.”

For now, North Carolina homeowners are bracing for gradual rate increases, hoping the settlement strikes the right balance between affordability and sustainability in the face of mounting challenges from natural disasters and inflation.