The Ultimate Guide to Building Good Credit

In the United States, credit plays a fundamental role in your financial well-being. It impacts everything from qualifying for loans and renting an apartment to securing the best insurance rates. But for many, understanding credit scores and credit reports can feel like navigating a financial labyrinth. This guide will equip you with the knowledge and actionable steps to build and improve your credit score, ultimately unlocking a world of financial opportunities.

Demystifying Credit Scores and Reports: The Building Blocks of Creditworthiness

Credit Scores: Imagine a three-digit number that summarizes your creditworthiness. That’s your credit score, a numerical representation calculated by credit bureaus based on your credit history. Scores typically range from 300 (poor) to 850 (excellent), with higher scores indicating a lower risk of delinquency (missing payments) to lenders.

There are three major credit bureaus in the US: Experian, Equifax, and TransUnion. Each bureau maintains a separate credit report on you, containing details like your credit card accounts, loans, and lines of credit, including account types, credit limits, and balances. While the credit scores from each bureau might vary slightly, they all paint a similar picture of your credit health.

Understanding Credit Report Components:

- Personal Information: Includes your name, address, Social Security number, and date of birth.

- Credit Accounts: Lists your credit cards, loans, and lines of credit, including account types, credit limits, and balances.

- Payment History: Records whether you’ve made payments on time (30+ days late are reported negatively).

- Credit Inquiries: Tracks recent inquiries from lenders when you apply for new credit.

Building Your Credit Score from Scratch: Taking the First Steps

If you’re new to credit or have a limited credit history, here’s how to get started:

- Open a Bank Account: Establishing a banking relationship demonstrates responsible financial management.

- Become an Authorized User: Ask someone with good credit to add you as an authorized user on their credit card. Their positive payment history will be reflected on your report.

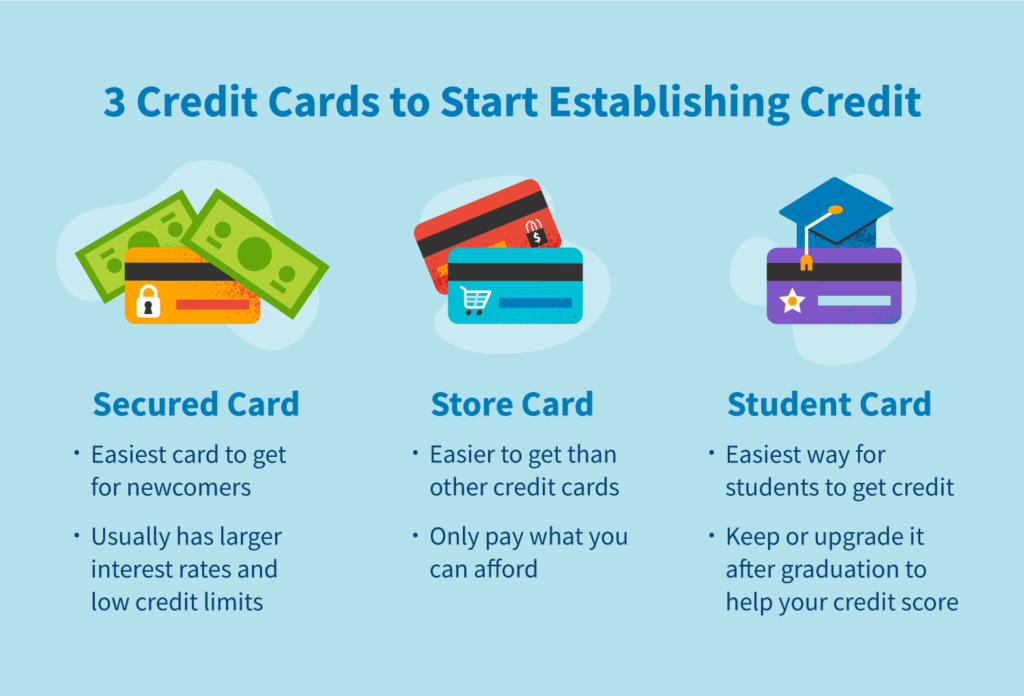

- Consider a Secured Credit Card: These cards require a security deposit that serves as your credit limit. Using the card responsibly and paying your balance on time builds positive credit history.

- Explore Credit-Builder Loans: These small loans are designed to help build credit. You make regular payments, and the lender holds the funds in a secured account until the loan is paid in full.

Building and Maintaining a Stellar Credit Score: Essential Habits

Once you have a credit line, focus on these key practices:

- Pay Your Bills on Time: This is the single most critical factor impacting your credit score. Set up automatic payments to avoid missed payments.

- Maintain Low Credit Utilization: Aim to keep your credit card balances below 30% of your credit limit. This demonstrates your ability to manage credit responsibly.

- Don’t Apply for Too Much Credit at Once: Multiple credit inquiries in a short period can negatively impact your score. Only apply for credit you truly need.

- Monitor Your Credit Reports Regularly: You’re entitled to a free credit report from each bureau annually. Review them for errors and dispute any inaccuracies promptly. You can request your free reports at Annual Credit Report.

- Keep Credit Accounts Open (Even with Zero Balances): A long credit history with responsible management can positively impact your score. Consider keeping older accounts open, even if you rarely use them.

Beyond the Score: The Importance of Good Credit

Building good credit goes beyond just a number. Here are some ways it empowers you financially:

- Qualify for Loans at Lower Interest Rates: A good credit score allows you to secure loans for cars, homes, and education at significantly lower interest rates. This translates to substantial savings over the life of the loan.

- Lower Insurance Rates: Many insurance companies offer better rates to customers with good credit scores.

- Secure Apartments and Utilities: Landlords and utility companies often check credit scores when approving applications. A good score makes it easier to secure desirable housing and utilities.

- Access to Better Credit Card Offers: With a good credit score, you’ll qualify for rewards cards with higher cashback or travel points, maximizing your spending benefits.

- Peace of Mind and Financial Security: Knowing you have a good credit score provides a sense of financial security and opens doors to greater financial opportunities in the future.

Credit Building Myths Debunked: Separating Fact from Fiction

- Myth: Checking Your Credit Report Hurts Your Score: Checking your credit reports yourself (not through a credit card offer) has no negative impact on your score. In fact, it’s crucial for monitoring your credit health. These self-initiated checks are considered “soft inquiries” and do not affect your score. It’s the inquiries made by lenders when you apply for new credit (“hard inquiries”) that can slightly lower your score.

- Myth: Closing Unused Credit Cards Improves Your Score: While it might seem logical, closing unused accounts with a long history can actually shorten your average credit age (the length of time you’ve had credit lines open), which can negatively impact your score. If the account has no annual fees and isn’t tempting you to overspend, consider keeping it open, especially if it has a high credit limit that contributes to a lower credit utilization ratio (total credit card balance divided by total credit limit).

- Myth: You Need a High Income to Build Good Credit: A high income isn’t a prerequisite for good credit. Responsible credit management is key. Focus on making on-time payments for any credit you have, regardless of the amount. Secured credit cards and credit-builder loans are excellent tools to build credit even with a limited income.

- Myth: Carrying a Balance on Your Credit Card Helps Your Score: This is a misconception. While having no credit history can be a hurdle, carrying a balance doesn’t necessarily build a good score. It’s your payment history that matters most. Aim to pay your credit card balance in full each month to avoid interest charges and demonstrate responsible credit usage.

By understanding these myths and practicing smart credit habits, you’ll be well on your way to building a strong credit score and achieving your financial goals.

Credit Building Challenges and Solutions:

Building good credit takes time and discipline. Here’s how to navigate some common roadblocks:

- Limited Income: If you have limited income, focus on managing existing debt responsibly. Consider using a secured credit card with a low limit and make on-time payments. Look for alternative ways to build credit, like becoming an authorized user on a trusted friend or family member’s account (with their permission) or exploring rent reporting services that report your on-time rent payments to credit bureaus.

- Past Credit Issues: Past delinquencies or mistakes can linger on your credit report for up to seven years (bankruptcies can stay for ten). Don’t despair! Focus on building positive credit habits moving forward. You can also dispute any errors on your credit report.

- No Credit History: This can be a hurdle, but the strategies mentioned earlier (secured credit cards, authorized user status, credit-builder loans) are designed to help establish a credit history.

Final Thoughts: Building Credit is a Journey, Not a Destination

Building good credit is a marathon, not a sprint. Be patient, stay disciplined, and celebrate your milestones. Remember:

- A good credit score is an investment in your financial future. The benefits you reap over time will be significant.

- There are resources available to help you on your journey. Don’t hesitate to seek guidance from credit counseling services or financial advisors.

- Building good credit empowers you to take control of your financial well-being. It opens doors to opportunities and gives you peace of mind.

By following the advice in this guide and staying committed to responsible credit management, you’ll be well on your way to achieving a stellar credit score and unlocking a brighter financial future.